Helicopter Market Size And Forecast (2025 - 2033), Global And Regional Growth, Trend, Share And Industry Analysis Report Coverage: By Type (Civil & Commercial Helicopter Market, Military Helicopter Market), By Maximum Take-Off Weight (MTOW) (Less Than 3,000 Kg, 3,000 Kg To 9,000 Kg, Greater Than 9,000 Kg), By Rotor Type (Single-Rotor Helicopters, Twin-Rotor Helicopters, Tiltrotor Helicopters, Others) By Engine Type (Single-Engine Helicopters, Twin-Engine Helicopters, Multi-Engine Helicopters) By Application (Emergency Medical Service, Corporate Service, Search And Rescue Operation, Oil & Gas, Defense, Homeland Security, Others) By Sales Channel (New, Pre-Owned), And Geography

2025-07-14

Aerospace & Defense

Description

Helicopter Market Overview

The Helicopter is anticipated to grow significantly from 2025 to 2033, driven by increasing demand across both military and civil aviation sectors. By 2025, the market is projected to reach a value of around USD 66.8 billion. Looking ahead to 2033, it is expected to expand further to about USD 182.2 billion. This represents an annual growth rate of 13.6% over the ten years.

Helicopters are indispensable for various applications, including emergency medical services, law enforcement, offshore oil and gas operations, search and rescue missions, and military combat and logistics. The market is witnessing a shift towards technologically advanced rotorcraft featuring enhanced fuel efficiency, reduced noise profiles, and advanced avionics systems. Governments around the world are expanding their rotary-wing aircraft capabilities to address growing national security and disaster response needs, while commercial operators are upgrading fleets to meet evolving operational standards and passenger expectations. One of the primary driving factors contributing to helicopter market growth is the increasing use of vertical lift platforms in urban mobility, including air taxis and cargo delivery solutions.

Helicopter Market Drivers and Opportunities

Growing demand for military modernization and combat readiness is anticipated to lift the helicopter market during the forecast period

One of the most significant drivers of the global helicopter market is the surge in military modernization programs worldwide. With rising geopolitical tensions, territorial disputes, and asymmetric warfare tactics, countries are increasingly prioritizing the procurement of advanced rotary-wing aircraft for troop transport, surveillance, search and rescue (SAR), and combat missions. Helicopters provide unparalleled versatility and can access terrain where fixed-wing aircraft cannot operate, making them indispensable in modern warfare. Nations like the United States, India, China, and Russia are continually upgrading their existing helicopter fleets with multi-role platforms capable of performing a variety of missions in both peacetime and conflict. Furthermore, defense budgets have expanded significantly in recent years, particularly in the Asia-Pacific and Middle East regions, where cross-border tensions and regional rivalries are on the rise. The integration of cutting-edge technologies such as stealth capabilities, enhanced avionics, and autonomous navigation systems is further boosting demand. Additionally, NATO and allied countries are also standardizing and modernizing their helicopter fleets to maintain operational compatibility and enhance rapid response capabilities. These strategic priorities collectively contribute to robust demand in the defense helicopter segment and are expected to sustain market growth over the forecast period.

Rising use of helicopters in emergency medical services and disaster relief is a vital driver for influencing the growth of the global helicopter market

Helicopters play a critical role in emergency medical services (EMS) and disaster relief operations due to their ability to quickly reach remote or inaccessible areas. The growing emphasis on improving public health infrastructure and rapid emergency response times is accelerating the deployment of air ambulances across urban and rural regions. In the aftermath of natural disasters such as earthquakes, floods, and wildfires, helicopters serve as lifelines for delivering food, supplies, and rescuing stranded individuals. Governments and private operators are increasingly investing in specialized medical helicopters equipped with advanced life-support systems, enabling faster patient transport and improving survival rates. This trend is particularly notable in developed markets like North America helicopter market and Europe helicopter market, where public-private partnerships are promoting air ambulance services as a critical component of national health and safety strategies. Furthermore, climate change has increased the frequency and severity of natural disasters globally, prompting humanitarian organizations and disaster management agencies to enhance their aerial response capabilities. These factors collectively boost the market for civil and para-public helicopters, with EMS emerging as a crucial growth vertical that complements the military and commercial segments.

Growing civil and tourism sector demand in emerging economies is poised to create significant opportunities in the global helicopter market

The growing middle class, increasing disposable income, and rising interest in adventure tourism are fueling demand for helicopter services in the civil aviation and tourism sectors, particularly in emerging economies. Countries such as India, Brazil, Indonesia, and South Africa are witnessing a surge in domestic tourism and luxury travel, where helicopters offer unique experiences and access to remote destinations. From aerial sightseeing tours over natural wonders to VIP transportation to resorts, helicopters are becoming a symbol of convenience and exclusivity. Governments are also recognizing the economic benefits of promoting heli-tourism and are investing in infrastructure such as helipads and landing zones at key tourist attractions. Furthermore, civil helicopter market use in areas such as agriculture (e.g., crop spraying), infrastructure development (e.g., powerline inspections), and news media is expanding rapidly. These applications not only diversify revenue streams for operators but also encourage OEMs to develop cost-effective, versatile platforms suited for multipurpose civil missions. As regulatory frameworks evolve to support non-military helicopter operations, the civil segment is expected to become a significant contributor to global helicopter market growth.

Helicopter Market Scope

|

Report Attributes |

Description |

|

Market Size in 2025 |

USD 66.8 Billion |

|

Market Forecast in 2033 |

USD 182.2 Billion |

|

CAGR% 2025-2033 |

13.6% |

|

Base Year |

2024 |

|

Historic Data |

2020-2024 |

|

Forecast Period |

2025-2033 |

|

Report USP |

Production, Consumption, company share, company heatmap, company

production capacity, growth factors, and more |

|

Segments Covered |

●

By Type ●

By Maximum Take-off Weight (MTOW) ●

By Rotor Type ●

By Engine Type ●

By Application ●

By Sales Channel |

|

Regional Scope |

●

North America ●

Europe ●

APAC ●

Latin America ●

Middle East and Africa |

|

Country Scope |

1)

U.S. 2)

Canada 3)

Germany 4)

UK 5)

France 6)

Spain 7)

Italy 8)

Switzerland 9)

China 10)

Japan 11)

India 12)

Australia 13)

South Korea 14)

Brazil 15)

Mexico 16)

Argentina 17)

South Africa 18)

Saudi Arabia 19) UAE |

Helicopter Market Report Segmentation Analysis

The Global Helicopter Market industry analysis is segmented by Type, Maximum Take-off Weight (MTOW), Rotor Type, Engine Type, Application, Sales Channel, and Region.

The civil & commercial helicopter market segment is anticipated to hold the highest share of the global helicopter market during the projected timeframe

By Type, the market is segmented into Civil & Commercial Helicopters and Military Helicopters. Among these, the Civil & Commercial Helicopter market segment is anticipated to hold the highest share of the global helicopter market during the projected timeframe, accounting for approximately 59.4% of the total market. This dominance is attributed to the growing applications of helicopters in corporate transport, emergency medical services, tourism, and offshore operations. Increasing urbanization, along with the rising demand for air mobility in congested metropolitan regions, is driving the use of helicopters for VIP transport and air taxi services.

The less than 3,000 kg segment is anticipated to hold the highest share of the market over the forecast period

Based on Maximum Take-Off Weight (MTOW), the market is segmented into Less than 3,000 Kg, 3,000 Kg to 9,000 Kg, and Greater than 9,000 Kg. The Less than 3,000 Kg segment is anticipated to hold the highest share of the market over the forecast period. Light helicopters in this category are particularly favored for their versatility, cost-effectiveness, and suitability for a wide range of civil applications such as training, air surveillance, tourism, and emergency response. Their ability to operate in constrained environments and lower operating costs makes them ideal for urban and rural missions alike. The growing popularity of light helicopters among private users and smaller operators is also contributing to the growth of this segment.

The single-rotor helicopters segment dominated the market in 2024 and is predicted to grow at the highest CAGR over the forecast period

By Rotor Type, the market is categorized into Single-Rotor Helicopters, Twin-Rotor Helicopters, Tiltrotor Helicopters, and Others. Among these, the Single-Rotor Helicopters segment dominated the market in 2024 and is predicted to grow at the highest CAGR over the forecast period. These helicopters offer efficient lift and simpler mechanics compared to other types, making them widely used across both civil and military operations. They are particularly common in utility roles, search and rescue, and pilot training.

The twin-engine helicopter market segment is predicted to grow at the highest CAGR over the forecast period

By Engine Type, the market is divided into Single-Engine Helicopters, Twin-Engine Helicopters, and Multi-Engine Helicopters. The Twin-Engine Helicopter market segment is projected to grow at the highest CAGR during the forecast period. These helicopters are preferred for operations requiring higher safety, longer range, and the capability to operate in challenging environments such as mountainous terrains or offshore helicopter services market. Twin-engine models are increasingly utilized in emergency medical services, corporate transport, and defense missions due to their redundancy and performance in adverse weather conditions.

The defense segment is expected to dominate the market during the forecast period

By Application, the market is segmented into Emergency Medical Service, Corporate Service, Search and Rescue Operation, Oil & Gas, Defense, Homeland Security, and Others. The Defense segment is expected to dominate the market during the forecast period. Defense helicopters are crucial for troop transport, surveillance, logistics support, and combat operations. With rising geopolitical tensions, cross-border conflicts, and increased military spending, several countries are investing heavily in rotary-wing aircraft to enhance national security and combat readiness.

The following segments are part of an in-depth analysis of the global Helicopter market:

|

Market Segments |

|

|

By Type |

● Civil & Commercial Helicopter Market o Light Helicopters o Medium Helicopters o Heavy Helicopters ● Military Helicopter Market o Attack Helicopters o Transport Helicopters o Reconnaissance Helicopters o Maritime Helicopters o Search and Rescue (SAR) Helicopters o Training Helicopters |

|

By Maximum Take-off Weight (MTOW) |

● Less than 3,000 Kg ● 3,000 Kg to 9,000 Kg ● Greater than 9,000 Kg |

|

By Rotor Type |

● Single-Rotor Helicopters ● Twin-Rotor Helicopters ● Tiltrotor Helicopters ● Others |

|

By Engine Type |

● Single-Engine Helicopters ● Twin-Engine Helicopters ● Multi-Engine Helicopters |

|

By Application |

● Emergency Medical Service ● Corporate Service ● Search and Rescue Operation ● Oil & Gas ● Defense ● Homeland Security ● Others |

|

By Sales Channel |

● New ● Pre-Owned |

Helicopter Market Share Analysis by Region

North America helicopter market is projected to hold the largest share of the global Helicopter market over the forecast period.

North America dominated the global helicopter market in 2024, accounting for a substantial 43.7% share, and is expected to maintain its leading position throughout the forecast period. This dominance is largely driven by robust defense spending, a mature aerospace industry, and strong demand for both military and civil helicopter market. The presence of leading helicopter manufacturers such as Bell Textron, Lockheed Martin (Sikorsky), and Boeing, along with ongoing procurement programs by the U.S. Department of Defense, significantly boosts market growth in the region. Additionally, there is a high demand for civil and commercial helicopters in North America for emergency medical services, law enforcement, search and rescue, and offshore operations, particularly in oil-rich regions such as the Gulf of Mexico. Stringent safety regulations, technological innovation, and favorable government initiatives supporting advanced rotorcraft programs further stimulate the helicopter market across the U.S. and Canada. The region also benefits from a strong aftermarket service ecosystem and skilled aviation workforce, which enhances the operational lifecycle and adoption of helicopters.

In contrast, the Asia-Pacific helicopter market is projected to register the highest CAGR during the forecast period. Rapid economic development, increasing defense budgets, and growing investments in urban air mobility are propelling demand for helicopters across countries like China, India, Japan, and South Korea. Expanding infrastructure in civil aviation, rising offshore exploration activities, and enhanced focus on border security and disaster management contribute to the region’s accelerating growth. Moreover, domestic manufacturing initiatives and strategic collaborations with global OEMs are expected to further strengthen Asia-Pacific’s footprint in the global helicopter market.

Helicopter Market Competition Landscape Analysis

The global helicopter market is characterized by a highly consolidated competitive landscape, dominated by a select group of industry leaders, including Airbus Helicopters, Textron (Bell), Leonardo, Lockheed Martin (Sikorsky), and Boeing. Collectively, these established players command the majority of the market share, leveraging their extensive expertise and resources to drive innovation.

Global Helicopter Market Recent Developments News:

- In June 2022: Airbus Helicopters SAS collaborated with KLK Motorsport and Modell- und Formenbau Blasius Gerg GmbH (both Germany) to co-develop the ultra-lightweight rear fuselage for its CityAirbus NextGen eVTOL aircraft. This multinational partnership accelerates progress on Airbus’ urban air mobility initiative through specialized lightweight structural engineering.

- In August 2023: The U.S. State Department greenlit Poland’s request to purchase 96 AH-64E Apache attack helicopters and associated systems in a potential $12 billion transaction. Upon delivery, Poland would become the second-largest operator of the advanced AH-64E variant globally, surpassing all non-U.S. military fleets. The deal underscores NATO’s eastern flank modernization amid heightened regional security demands.

The GlobalHelicopter Market is dominated by a few large companies, such as

● Airbus Helicopters

● Bell Textro

● Leonardo Helicopters

● Sikorsky Aircraft (a Lockheed Martin company)

● Russian Helicopters (Rostec)

● Boeing

● MD Helicopters

● Robinson Helicopter Company

● Kaman Aerospace

● Enstrom Helicopter Corporation

● Kawasaki Heavy Industries Ltd.

● Hindustan Aeronautics Limited (HAL)

● Korea Aerospace Industries (KAI)

● AVIC Helicopter (AVICOPTER)

● NHIndustries

● Others

FAQs

Frequently Asked Questions

1. Global Helicopter Market Introduction and Market Overview

1.1. Objectives of the Study

1.2. Global Helicopter Market Scope and Market Estimation

1.2.1. Global Helicopter Overall Market Size (US$ Bn), Market CAGR (%), Market forecast (2025 - 2033)

1.2.2. Global Helicopter Market Revenue Share (%) and Growth Rate (Y-o-Y) from 2020 - 2033

1.3. Market Segmentation

1.3.1. Type of Global Helicopter Market

1.3.2. Maximum Take-off Weight (MTOW) of Global Helicopter Market

1.3.3. Rotor Type of Global Helicopter Market

1.3.4. Engine Type of Global Helicopter Market

1.3.5. Application of Global Helicopter Market

1.3.6. Sales Channel of Global Helicopter Market

1.3.7. Region of Global Helicopter Market

2. Executive Summary

2.1. Demand Side Trends

2.2. Key Market Trends

2.3. Market Demand (US$ Bn) Analysis 2021 – 2024 and Forecast, 2025 – 2033

2.4. Demand and Opportunity Assessment

2.5. Demand Supply Scenario

2.6. Market Dynamics

2.6.1. Drivers

2.6.2.Limitations

2.6.3. Opportunities

2.6.4.Impact Analysis of Drivers and Restraints

2.7. Emerging Trends for Helicopter Market

2.8. Porter’s Five Forces Analysis

2.9. PEST Analysis

2.10. Key Regulation

3. Global Helicopter Market Estimates & Historical Trend Analysis (2021 - 2024)

4. Global Helicopter Market Estimates & Forecast Trend Analysis, by Type

4.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Type, 2020 - 2033

4.1.1. Civil & Commercial Helicopter Market

4.1.1.1. Light Helicopters

4.1.1.2. Medium Helicopters

4.1.1.3. Heavy Helicopters

4.1.2. Military Helicopter Market

4.1.2.1. Attack Helicopters

4.1.2.2. Transport Helicopters

4.1.2.3. Reconnaissance Helicopters

4.1.2.4. Maritime Helicopters

4.1.2.5. Search and Rescue (SAR) Helicopters

4.1.2.6. Training Helicopters

5. Global Helicopter Market Estimates & Forecast Trend Analysis, by Maximum Take-off Weight (MTOW)

5.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Maximum Take-off Weight (MTOW), 2020 - 2033

5.1.1. Less than 3,000 Kg

5.1.2. 3,000 Kg to 9,000 Kg

5.1.3. Greater than 9,000 Kg

6. Global Helicopter Market Estimates & Forecast Trend Analysis, by Rotor Type

6.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Rotor Type, 2020 - 2033

6.1.1. Single-Rotor Helicopters

6.1.2. Twin-Rotor Helicopters

6.1.3. Tiltrotor Helicopters

6.1.4. Others

7. Global Helicopter Market Estimates & Forecast Trend Analysis, by Engine Type

7.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Engine Type, 2020 - 2033

7.1.1. Single-Engine Helicopters

7.1.2. Twin-Engine Helicopters

7.1.3. Multi-Engine Helicopters

8. Global Helicopter Market Estimates & Forecast Trend Analysis, by Application

8.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Application, 2020 - 2033

8.1.1. Emergency Medical Service

8.1.2. Corporate Service

8.1.3. Search and Rescue Operation

8.1.4. Oil & Gas

8.1.5. Defense

8.1.6. Homeland Security

8.1.7. Others

9. Global Helicopter Market Estimates & Forecast Trend Analysis, by Sales Channel

9.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Sales Channel, 2020 - 2033

9.1.1. New

9.1.2. Pre-Owned

10. Global Helicopter Market Estimates & Forecast Trend Analysis, by Region

10.1. Global Helicopter Market Revenue (US$ Bn) Estimates and Forecasts, by Region, 2020 - 2033

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. Latin America

11. North America Helicopter Market: Estimates & Forecast Trend Analysis

11.1. North America Helicopter Market Assessments & Key Findings

11.1.1. North America Helicopter Market Introduction

11.1.2. North America Helicopter Market Size Estimates and Forecast (US$ Billion) (2020 - 2033)

11.1.2.1. By Type

11.1.2.2.By Maximum Take-off Weight (MTOW)

11.1.2.3.By Rotor Type

11.1.2.4.By Engine Type

11.1.2.5.By Application

11.1.2.6. By Sales Channel

11.1.2.7. By Country

11.1.2.7.1. The U.S.

11.1.2.7.2. Canada

12. Europe Helicopter Market: Estimates & Forecast Trend Analysis

12.1. Europe Helicopter Market Assessments & Key Findings

12.1.1. Europe Helicopter Market Introduction

12.1.2. Europe Helicopter Market Size Estimates and Forecast (US$ Billion) (2020 - 2033)

12.1.2.1.By Type

12.1.2.2. By Maximum Take-off Weight (MTOW)

12.1.2.3. By Rotor Type

12.1.2.4. By Engine Type

12.1.2.5. By Application

12.1.2.6. By Sales Channel

12.1.2.7. By Country

12.1.2.7.1. Germany

12.1.2.7.2. Italy

12.1.2.7.3. U.K.

12.1.2.7.4. France

12.1.2.7.5. Spain

12.1.2.7.6. Switzerland

12.1.2.7.7. Rest of Europe

13. Asia Pacific Helicopter Market: Estimates & Forecast Trend Analysis

13.1. Asia Pacific Market Assessments & Key Findings

13.1.1. Asia Pacific Helicopter Market Introduction

13.1.2. Asia Pacific Helicopter Market Size Estimates and Forecast (US$ Billion) (2020 - 2033)

13.1.2.1.By Type

13.1.2.2. By Maximum Take-off Weight (MTOW)

13.1.2.3. By Rotor Type

13.1.2.4. By Engine Type

13.1.2.5. By Application

13.1.2.6. By Sales Channel

13.1.2.7. By Country

13.1.2.7.1. China

13.1.2.7.2. Japan

13.1.2.7.3. India

13.1.2.7.4. Australia

13.1.2.7.5. South Korea

13.1.2.7.6. Rest of Asia Pacific

14. Middle East & Africa Helicopter Market: Estimates & Forecast Trend Analysis

14.1. Middle East & Africa Market Assessments & Key Findings

14.1.1. Middle East & Africa Helicopter Market Introduction

14.1.2. Middle East & Africa Helicopter Market Size Estimates and Forecast (US$ Billion) (2020 - 2033)

14.1.2.1.By Type

14.1.2.2. By Maximum Take-off Weight (MTOW)

14.1.2.3. By Rotor Type

14.1.2.4. By Engine Type

14.1.2.5. By Application

14.1.2.6. By Sales Channel

14.1.2.7. By Country

14.1.2.7.1. UAE

14.1.2.7.2. Saudi Arabia

14.1.2.7.3. South Africa

14.1.2.7.4. Rest of MEA

15. Latin America Helicopter Market: Estimates & Forecast Trend Analysis

15.1. Latin America Market Assessments & Key Findings

15.1.1. Latin America Helicopter Market Introduction

15.1.2. Latin America Helicopter Market Size Estimates and Forecast (US$ Billion) (2020 - 2033)

15.1.2.1.By Type

15.1.2.2. By Maximum Take-off Weight (MTOW)

15.1.2.3. By Rotor Type

15.1.2.4. By Engine Type

15.1.2.5. By Application

15.1.2.6. By Sales Channel

15.1.2.7. By Country

15.1.2.7.1. Brazil

15.1.2.7.2. Argentina

15.1.2.7.4. Rest of LATAM

16. Country Wise Market: Introduction

17. Competition Landscape

17.1. Global Helicopter Market Product Mapping

17.2. Global Helicopter Market Concentration Analysis, by Leading Players / Innovators / Emerging Players / New Entrants

17.3. Global Helicopter Market Tier Structure Analysis

17.4. Global Helicopter Market Concentration & Company Market Shares (%) Analysis, 2023

18. Company Profiles

18.1. Airbus Helicopters

18.1.1. Company Overview & Key Stats

18.1.2. Financial Performance & KPIs

18.1.3. Product Portfolio

18.1.4. SWOT Analysis

18.1.5. Business Strategy & Recent Developments

* Similar details would be provided for all the players mentioned below

18.2. Bell Textro

18.3. Leonardo Helicopters

18.4. Sikorsky Aircraft (a Lockheed Martin company)

18.5. Russian Helicopters (Rostec)

18.6. Boeing

18.7. MD Helicopters

18.8. Robinson Helicopter Company

18.9. Kaman Aerospace

18.10. Enstrom Helicopter Corporation

18.11. Kawasaki Heavy Industries Ltd.

18.12. Hindustan Aeronautics Limited (HAL)

18.13. Korea Aerospace Industries (KAI)

18.14. AVIC Helicopter (AVICOPTER)

18.15. NHIndustries

18.16. Others

19. Research Methodology

19.1. External Transportations / Databases

19.2. Internal Proprietary Database

19.3. Primary Research

19.4. Secondary Research

19.5. Assumptions

19.6. Limitations

19.7. Report FAQs

20. Research Findings & Conclusion

Our Research Methodology

"Insight without rigor is just noise."

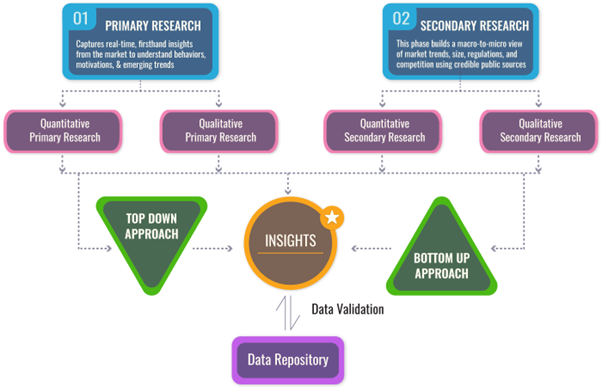

We follow a comprehensive, multi-phase research framework designed to deliver accurate, strategic, and decision-ready intelligence. Our process integrates primary and secondary research , both quantitative and qualitative , along with dual modeling techniques ( top-down and bottom-up) and a final layer of validation through our proprietary in-house repository.

PRIMARY RESEARCH

Primary research captures real-time, firsthand insights from the market to understand behaviors, motivations, and emerging trends.

1. Quantitative Primary Research

Objective: Generate statistically significant data directly from market participants.

Approaches:- Structured surveys with customers, distributors, and field agents

- Mobile-based data collection for point-of-sale audits and usage behavior

- Phone-based interviews (CATI) for market sizing and product feedback

- Online polling around industry events and digital campaigns

- Purchase frequency by customer type

- Channel performance across geographies

- Feature demand by application or demographic

2. Qualitative Primary Research

Objective: Explore decision-making drivers, pain points, and market readiness.

Approaches:- In-depth interviews (IDIs) with executives, product managers, and key decision-makers

- Focus groups among end users and early adopters

- Site visits and observational research for consumer products

- Informal field-level discussions for regional and cultural nuances

SECONDARY RESEARCH

This phase helps establish a macro-to-micro understanding of market trends, size, regulation, and competitive dynamics, sourced from credible and public domain information.

1. Quantitative Secondary Research

Objective: Model market value and segment-level forecasts based on published data.

Sources include:- Financial reports and investor summaries

- Government trade data, customs records, and regulatory statistics

- Industry association publications and economic databases

- Channel performance and pricing data from marketplace listings

- Revenue splits, pricing trends, and CAGR estimates

- Supply-side capacity and volume tracking

- Investment analysis and funding benchmarks

2. Qualitative Secondary Research

Objective: Capture strategic direction, innovation signals, and behavioral trends.

Sources include:- Company announcements, roadmaps, and product pipelines

- Publicly available whitepapers, conference abstracts, and academic research

- Regulatory body publications and policy briefs

- Social and media sentiment scanning for early-stage shifts

- Strategic shifts in market positioning

- Unmet needs and white spaces

- Regulatory triggers and compliance impact

DUAL MODELING: TOP-DOWN + BOTTOM-UP

To ensure robust market estimation, we apply two complementary sizing approaches:

Top-Down Modeling:- Start with broader industry value (e.g., global or regional TAM)

- Apply filters by segment, geography, end-user, or use case

- Adjust with primary insights and validation benchmarks

- Ideal for investor-grade market scans and opportunity mapping

- Aggregate from the ground up using sales volumes, pricing, and unit economics

- Use internal modeling templates aligned with stakeholder data

- Incorporate distributor-level or region-specific inputs

- Most accurate for emerging segments and granular sub-markets

DATA VALIDATION: IN-HOUSE REPOSITORY

We close the loop with proprietary data intelligence built from ongoing projects, industry monitoring, and historical benchmarking. This repository includes:

- Multi-sector market and pricing models

- Key trendlines from past interviews and forecasts

- Benchmarked adoption rates, churn patterns, and ROI indicators

- Industry-specific deviation flags and cross-check logic

- Catches inconsistencies early

- Aligns projections across studies

- Enables consistent, high-trust deliverables